In Phoenix, Arizona, synthetic ID fraud, or the "Phoenix problem," poses a significant challenge due to its advanced techniques using fabricated data. To combat this, both financial institutions and individuals must adopt robust cybersecurity measures, regular updates, and monitoring for suspicious activities. A multi-layered approach including encryption, strong password policies, 2FA, advanced analytics, knowledge of fraud trends, and digital literacy is essential. Advanced technology like biometric authentication and AI enhance security by verifying unique traits and detecting suspicious patterns in datasets, providing the best identity theft protection for Phoenix residents and businesses.

“In the digital age, synthetic ID fraud poses a significant threat, with identity thieves crafting false identities to exploit vulnerable systems. This article explores the complex world of synthetic ID fraud, focusing on the unique challenges faced by Arizona residents. We delve into ‘Understanding Identity Synthetic ID Fraud: The Phoenix Problem,’ uncover best practices for detection and prevention in Phoenix, and highlight the transformative role of technology in safeguarding against synthetic ID theft, offering valuable insights for best identity theft protection in Phoenix, Arizona.”

- Understanding Identity Synthetic ID Fraud: The Phoenix Problem

- Best Practices for Effective Detection and Prevention in Arizona

- The Role of Technology in Protecting Against Synthetic ID Theft

Understanding Identity Synthetic ID Fraud: The Phoenix Problem

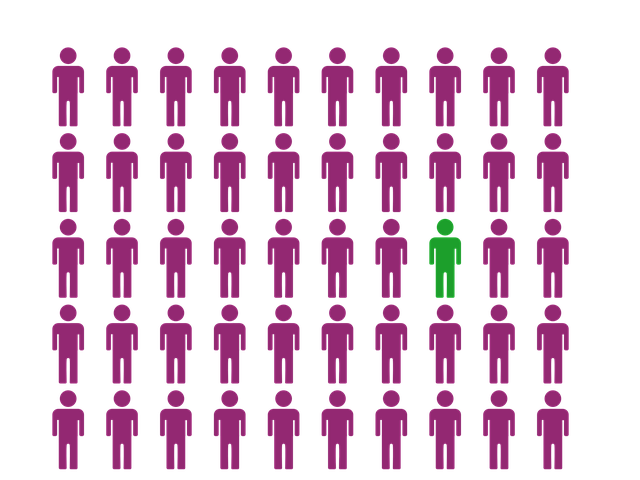

Identity synthetic ID fraud, also known as the “Phoenix problem,” is a growing concern in today’s digital age. It refers to the creation and use of fake identities, often with the intention to commit fraud or gain unauthorized access. Unlike traditional identity theft, where criminals steal existing personal information, synthetic ID fraud involves crafting entirely new identities from scratch using false documents, fabricated data, and sophisticated online techniques. This makes it a particularly challenging issue for security experts and law enforcement in Phoenix, Arizona, where the absence of real-life interactions makes it easier to conceal fraudulent activities.

The best identity theft protection measures are crucial in combating this complex problem. In Phoenix, Arizona, where a vibrant digital landscape coexists with a bustling metropolis, advanced cybersecurity solutions are essential. Financial institutions and individuals alike must stay vigilant by implementing robust security protocols, regularly updating software, and monitoring for suspicious activities. Additionally, staying informed about the latest fraud trends and utilizing reliable identity monitoring services can significantly contribute to mitigating risks associated with synthetic ID fraud.

Best Practices for Effective Detection and Prevention in Arizona

In Phoenix, Arizona, best practices for effective identity fraud detection and prevention involve a multi-layered approach. One key strategy is to implement robust data security measures, such as encryption, access controls, and regular system updates. Financial institutions and businesses should also encourage customers to adopt strong password policies and enable two-factor authentication (2FA) for added protection. Additionally, continuous monitoring of transaction activities using advanced analytics can help identify suspicious patterns indicative of synthetic ID fraud.

Another vital practice is staying informed about emerging trends and techniques used by fraudsters. Arizona’s law enforcement agencies collaborate closely with financial institutions to share intelligence and best practices. Regular training sessions for employees on fraud awareness and customer service can also significantly contribute to early detection. Moreover, promoting digital literacy among residents in Phoenix ensures that they are equipped to recognize potential scams and protect their personal information, making it a comprehensive strategy for best identity theft protection.

The Role of Technology in Protecting Against Synthetic ID Theft

In the digital age, where personal information is increasingly accessible, protecting against synthetic ID fraud has become a paramount concern. The best identity theft protection in Phoenix, Arizona, leverages advanced technology to stay ahead of sophisticated criminals who create and use synthetic identities for malicious purposes. Biometric authentication, for instance, adds an extra layer of security by verifying unique physical traits like fingerprints or facial recognition, making it much harder for thieves to impersonate individuals.

Additionally, artificial intelligence (AI) plays a crucial role in detecting patterns and anomalies in vast datasets, enabling financial institutions and businesses to identify suspicious activities and potential synthetic ID frauds promptly. Machine learning algorithms can analyze behavior patterns, transaction histories, and other data points to flag unusual activities that might indicate identity theft. This proactive approach ensures that the best identity theft protection measures are in place, safeguarding individuals and organizations alike in Phoenix, Arizona, and beyond.

In the ever-evolving landscape of digital security, synthetic ID fraud poses a significant threat, but with the right tools and strategies, it can be effectively mitigated. Arizona’s best practices in detection and prevention highlight the importance of staying ahead of this complex and insidious crime. By leveraging advanced technology tailored to synthetic ID theft protection, individuals and businesses alike can safeguard their identities and financial security. Choosing a robust solution for identity theft protection Phoenix Arizona residents trust is key to navigating this modern-day enigma and ensuring a safer digital future.